UKRAINE CRISIS BRIEFING

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 August

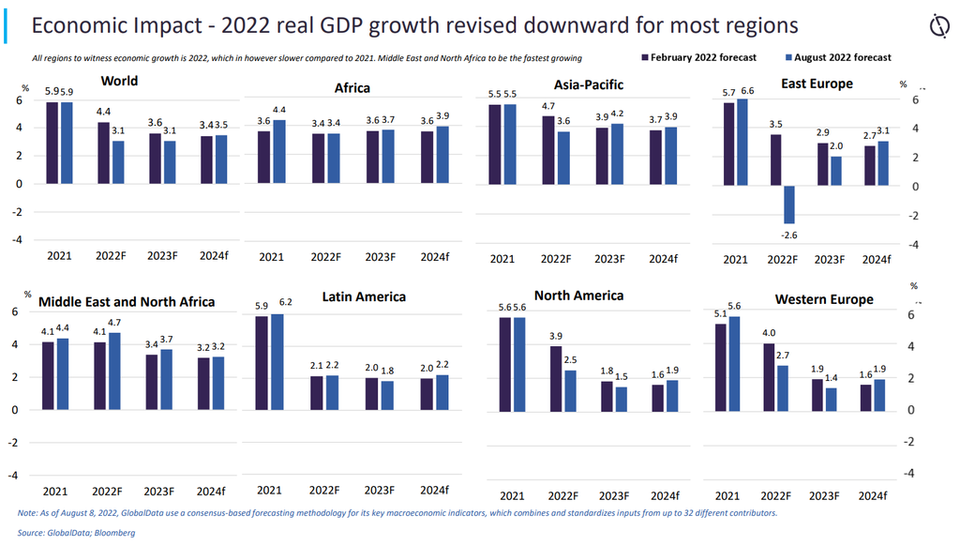

GlobalData forecasts that the world economy will grow at a slower pace of 3.1% in 2022 following a 5.9% growth in 2021. Global inflation is projected to rise to 7.5% in 2022 from 3.5% in the previous year due to supply chain disruption.

Real GDP growth for Asia-Pacific has been revised down by 1.1 percentage points (pp), East Europe by 6.1pp, West Europe by 1.3pp and North America by 1.4pp in August 2022 compared to February 2022 projections.

- SECTOR IMPACT: TRAVEL AND TOURISM -

Latest update: 16 August

Key Travel And Tourism developments

Revenue impact

Sector analysis from UK-based hotel booking platform hoo states that the Ukraine crisis could cost $10.6bn in lost tourism revenue across Ukraine, Russia, Belarus, and Moldova, with further impacts likely to be felt across neighbouring countries. The loss of Russian and Ukrainian tourists will

prolong the Covid-19 recovery timelines of specific destinations.

According to GlobalData, in 2021, combined outbound tourist expenditure from Russia and Ukraine accounted for 3.5% of total global outbound tourist expenditure. With the conflict and sanctions impacting both economies, a significantly reduced number of travellers from both countries will be taking

trips internationally in 2022, which will contribute to an uneven tourism recovery from the pandemic.

In Cyprus, Russian visitation accounted for 6% of total inbound trips within the top 10 inbound source markets. Although this percentage is not overwhelming, it makes Russia an important source market for Cyprus.

According to GlobalData’s Q3 2021 Consumer Survey, 61% of Russians stated that they typically undertake sun and beach trips, which means Russians will especially be missed by Cyprus’ popular coastal regions, impacting the revenues of many businesses connected to the travel and tourism industry in these areas, such as all-inclusive hotels in Limassol.

SANCTIONS

Egypt is now looking to capitalise on a lack of outbound options for Russian travellers, created by sanctions. Conversations between Egypt and Russia to apply the Russian payment system MIR in Egyptian resorts have occurred. In previous years, tourists from Russia and Ukraine have accounted for up to 40% of beach holidaymakers in Egypt, according to the Ministry of Tourism and the Egyptian Chamber of Tourist Establishments.

However, inbound flows from these two countries have been heavily impacted by the conflict, which has had a knock-on impact on Egypt’s tourism industry. According to Russian tour agency Travelata, Egypt was in the top five tourist destinations for Russian tourists for the Summer of 2022. Egypt is now looking to capitalise on this pent-up demand by enhancing accessibility for Russian travellers.

Luxury cruise company, Tradewind Voyages, which operates the Golden Horizon, has paused operations due to sanctions against Russia. The company has been impacted by sanctions placed on its major lender VTB bank, Germany, which has its headquarters based in Russia. This shows that travel and tourism companies may still be heavily impacted by sanctions indirectly, even when they have no physical presence in Russia and Ukraine.